Finding Happiness Again and the Pursuit of Financial Independence

When I was a young startup entrepreneur scraping by on mac and hot dogs, a friend of mine told me he paid himself $48,000 per year out of his business. I remember thinking, “Gosh… that is a lot of money. What in the world would I ever do with $4,000 per month? I would have it made!”

But it wasn’t long… and I too had a $50k a year draw.

Turns out I acclimated quickly and no longer had the sense of “having it made” I thought I would.

And this cycle continued upward.

When I started thinking “When I earn $500,000 in a year – then I’ll have it made” I realized I might have an optics problem.

Just seemed like no matter how much money I had in my life, it was never enough.

The crazy part was how much my overall sense of purpose and well-being became married to the pursuit of more. New and shiny phone. Faster and more lux car. Bigger and better house. I became addicted to the modern day miracle of one-click purchasing on Amazon (in 2016 I made 109 orders… that’s an Amazon order every 3.3 days!). And I stopped doing a lot of basic things around my house… like yard work, house maintenance, cleaning, grocery shopping and food prep through the use of trendy new services and regular ‘ol hired help.

Always in the pursuit of “optimization.”

Even trading innovative service recommendations with other successful entrepreneurs that would eliminate more of the mundane tasks from my life. Always working to reduce responsibility or hard work outside of my chosen area of professional focus. I think in hindsight I was optimizing my own comfort, which I think I believed was synonymous with happiness.

Turns out it’s not.

When I got to thinking about it – most of my big breakthroughs and ‘ah hah’ moments came when my head was down doing manual work outside of my usual computer-based professional time. It’s when I’m painting my sons bedroom, mowing the lawn, or installing new tile for my bathroom floor that I get relaxed enough and away from the *immediate* problems of the normal business day that give my brain the Alpha boosts it needs for the next breakthrough.

In the days following the birth of my second son this past February… I began taking a fearless inventory of who I was, the thoughts occupying my head, and the general purpose behind my entrepreneurial pursuits.

I started to recognize that I really wasn’t happy. I worked a lot. My work is meaningful and fun and amazing. I had a lot of help around the house so I could work even more. And I had an insane amount of great things that made my life easier and more convenient.

I was comfortable, but not happy.

Admitting that you aren’t happy is not an easy thing.

Thankfully, in the wee hours of the night while watching my newborn, I stumbled across the movie Minimalism.

I felt like someone jumped out of the screen and punched me in the face. Perhaps it was because I was extremely sleep deprived with just a week old newborn. Or perhaps it was the beginning of the ultra-consumer soul buried deep within me dying.

The big takeaway from the film for me was:

“Love People, Use Stuff”

And it occurred to me how simple language like, “I love my car,” or “I love my iPhone” – although probably not meant literally – had actually crept into my life. How often had I wasted hours researching the newest device or gadget thinking that it would help me finally achieve a better state of happiness?

It’s easy to get sucked into not wanting to make radical change in our lives due to stuff holding us hostage.

A while back I read Essentialism which advocated a similar and simple idea of “Less but better” which I had applied to my business, but not so much to my life outside of entrepreneurship.

I wrote a personal manifesto.

Shared it with Emily.

She suggested the movie Happy.

This movie added a few more basic ideas to my new mindset. Turns out, I had been focusing a lot on extrinsic goals (money, status and power) – and most of us are better off when we pursue intrinsic goals when it comes to raw life satisfaction and true happiness.

The three intrinsic goals the film reviews:

Personal growth

Develop meaningful relationships with friends and family

Serve your community by giving back or helping others

The final domino for me fell when one of the investing platforms I use, Betterment, raised their prices. To find out what was up, I stumbled upon a blogger covering the price increase.

Turns out this Mr. Money Mustache (or MMM for short) had a lot more in store for me. In hindsight, the increase in Betterment’s pricing – while annoying – will probably add at least a million dollars to my net worth over the next twenty years by implementing Mustachianism.

MMM “retired” when he achieved Financial Independence at the ripe young age of 30 through earning a pretty average amount of money and saving most of it through “badassity” or sophisticated frugality, investing his savings, and avoiding becoming an ultra-consumer like the rest of us. The crazy part is… he really never gave up any mainstream luxuries to achieve it.

AND, more importantly, much of this badassity, frugality, and more intentional living put him into an almost constant state of HAPPINESS and JOY.

One of the things MMM has helped me see is that most of us in the US make a boatload of money right now – not some fantasy future date we’ll eventually arrive at (the constant cycle I’ve found myself in for the last decade). We have just become accustomed to spending pretty much everything we make. To the tune that most people consider a 10% savings rate worthy of a high five (it’s not – it’s actually bare minimum and we should all probably be more in the 50-75% ballpark).

I am not pursuing financial success so that I can live a luxurious life full of bling. I don’t want to be a gagillionaire on a yacht with fancy martinis and a butler. That is one outcome of wealth (or perhaps just spending wealth). I want to become wealthy so my money works for me and I don’t have to anymore.

I want to spend time with my family, educating my sons about how to live a life with purpose, be an amazing partner and best friend to my wife, do great work that helps others with fun and interesting people, and leave the world better than I found it.

I want to be financially independent so I can live a life without compromise. I want each hour on this earth to build a deeper sense of freedom and happiness for myself and those around me.

I think one of the big shifts for me this year was realizing that I wanted to drastically move up my financial independence goal. Like many – I saw a more traditional retirement in my future. Something achieved at 55 or 60 or so…

What MMM helped me realize was that I could move that target up to something much more audacious – like 7 to 10 years by spending a lot less on all these things adding comfort (but not happiness) to my life.

So far this year, I have made a handful of Quickstart moves in this pursuit:

Purchased a used bike on Craigslist and began using it for my regular transportation around town. This has been incredibly liberating. While it takes a bit longer to get places – the exercise I’m getting means I don’t have to go to the gym – a very time consuming (and expensive) activity. Another benefit so far has been working out my willpower muscle a bit more. Once you’ve biked to work in the freezing rain in a pair of shorts… all of the other challenges you have that day seem a bit easier.

Cancelled almost all forms of domestic outsourcing (cleaners, yard help, food delivery, night nanny, etc). I say almost because there will undoubtedly be a need for childcare with our nanny from time to time.

Kicked my takeout coffee habit. A lot of financial bloggers and luminaries proclaim that cutting small expenses like coffee is a fools errand on your way to becoming a millionaire – but MMM gives you a simple formula on how to calculate the lifetime return. Multiply any weekly expense by 752 (monthly by 173) and you’ll get the 10-year return of that money if you chose instead to invest it. The $30 per week I spent on coffee will add up to $22,560 or enough money for an all expense paid month in a castle in France, but I’m working on financial independence – not a cool vacation. By the time I’m 65 – this habit change will add approximately $160,148 to my net worth. This is a significant amount of money – which for most people would shave 2-5 years off the necessary working years. Buying coffee out doesn’t make me feel guilty – it’s more that I now realize that I can make coffee at home for 1/10th the cost and the effect is the exact same for me: caffeine in the blood.

Cut way back on eating out. While this has required some additional time planning meals and my week, I don’t think it takes up more time – eating out is a time consuming affair after all. Doesn’t hurt that Emily is a fantastic chef (who loves cooking). Why do we ever eat out? Let alone to the tune of $6k+ per year! We live pretty active lives… and it can be easy to just run out of the house without thinking. Now we’re like, “what can we grab to snack on or for a meal on the run?” which is great because now we have small picnics on our outings regularly. And who doesn’t love a picnic!

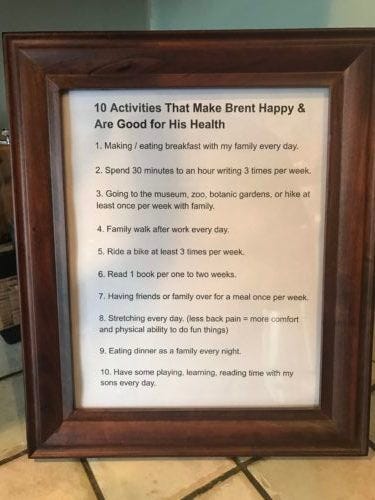

Created a list of 10 activities that make me happy and are healthy for me. Funny enough – not one of them costs any money. Already I have found myself looking here first when I have a smidgen of free time. And there isn’t a whole lot of time for things that cost money once I’ve cleared through the list.

Cut several subscription services that were not helping me grow as an individual. Mostly news services… that if anything were distracting me from what’s important. And making my overall head a noisy place.

Writing at least a few times per week again. Writing for U Gurus or even my own blog always makes me feel like I did something useful. And it’s an activity that is expanding my influence in the world and not just making my hair turn grey faster like reading the NYT.

I have a few other things in the works (some big, some small) that I’m really excited about which I plan to blog about in the near future.

And the good news is I’m finding my mojo again. I’m feeling more creative, driven, and happy each and every day. At a time when I am extremely sleep deprived and should be at my wits end – I’m full of energy and excited about life!

All without moving to a swank house, upgrading my car, or outsourcing another task around the house.

So there you have it. A taste of where I’m headed and why I think it’s awesome.

If you’re an entrepreneur pursuing financial freedom and happiness – I’d love to hear about it…

What’s working for you?